Domestic Reverse Charge for VAT within CIS

So you’re VAT registered and operate in construction. As if HMRC haven’t made things complicated enough for you with CIS, they now want you to operate multiple approaches to VAT - what a headache! This blog will hopefully shed some light on when and how you should apply the Domestic Reverse Charge (DRC) rate of VAT both on purchases and sales.

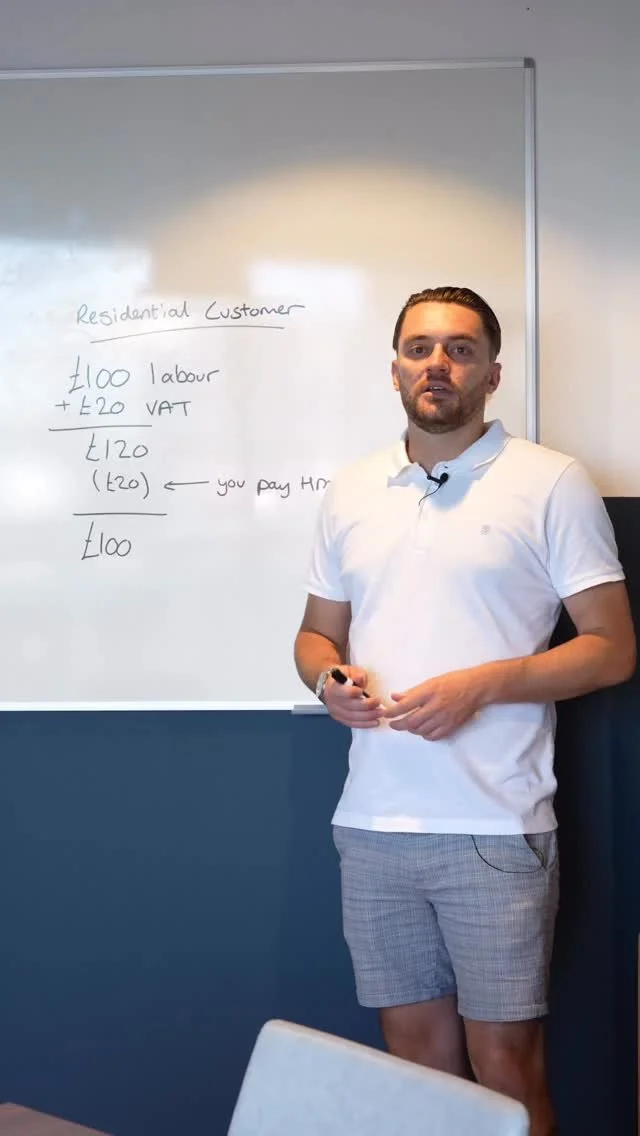

First of all, it is important to note that the Domestic Reverse Charge (DRC) rate of VAT only applies on construction services within the Construction Industry Scheme (CIS) and when your customer is also registered for VAT. This means that when you are invoicing a standard residential / domestic customer, you should apply 20% VAT to both your labour and materials as standard.

Though do remember that different rates of VAT can apply for certain work, such as new builds or installing energy saving devices for those over 60. More information on this can be found here.

VAT on Sale of Services to Contractors

If you are working for someone under the CIS mechanism, such as a contractor on a job, any labour you charge will be subject to CIS tax which your contractor will deduct and pay to HMRC for you to claim back.

When charging VAT on CIS services provided to contractors, the DRC rate comes into play. Your invoice must state that the “Domestic Reverse Charge Rate Applies” (most good accounting software, such as Xero, has this as an option when creating an invoice) which essentially means that you are not charging them VAT. Instead, they will need to account for the VAT on their tax return, which we will explain below.

VAT on Sale of Materials to Contractors

If you are charging for materials on a job that includes labour within CIS, then these materials should also be subject to the DRC. In this case, you effectively do not charge VAT on materials, despite having paid VAT on the purchases and reclaimed on your VAT Return.

You should note that this only applies on invoices where labour is included. Materials that are charged on an invoice on their own, or with other materials only, you should charge VAT on as normal.

See below 2 examples of how the Domestic Reverse Charge mechanism works in practice:

You are required to pay the £500 of VAT collected from Jane Smith to HMRC, netting £2,500.

You are able to reclaim the £400 of CIS collected by Joe Bloggs Construction from HMRC, netting £2,500.

Therefore the net amount received for both types of services are the same, it is just your cashflow which is affected.

Accounting for VAT on Purchases that are Domestic Reverse Charged

If a subcontractor is VAT registered and working for you, then you should be aware of how to record the VAT on your own VAT return. Their invoice should state when the DRC applies, although they may not often be aware so you should consider the above points and alert them if they are charging you VAT incorrectly.

For any labour or materials that are subject to DRC, you should enter them using a “Domestic Reverse Charge on Purchases” code. This will not change the amount due to the subcontractor, but will reflect both output and input VAT on your own VAT return. The net effect of doing this is nil and there will be no VAT to pay or reclaim to HMRC on these items, however it is important for this to be done so that HMRC is aware of why no VAT is being paid and collected.

Sales to an “End User”

You may sometimes have a contractor that tells you they are an “End User” and therefore the DRC does not apply. In these cases, you must charge VAT on both labour and materials as normal, despite you working for them under CIS. You should ensure you have written confirmation from the contractor that they are an end user before doing so.

An end user is not simply the final contractor who then charges the residential customer VAT as normal, so please do not assume you are an end user based on this alone. There are a number of factors that determine what an end user is, but it is relatively uncommon for smaller businesses and you can simply take their confirmation in writing with no further checks necessary.

Please note the above material does not constitute advice in any way. The blog has been provided for informational purposes only and should not be relied on for tax, legal or accounting advice. You should consult with your own accountant before engaging in any transaction, or alternatively contact us directly.

More articles

Like what you see here? Here is some more great accounting advice.